Sources:

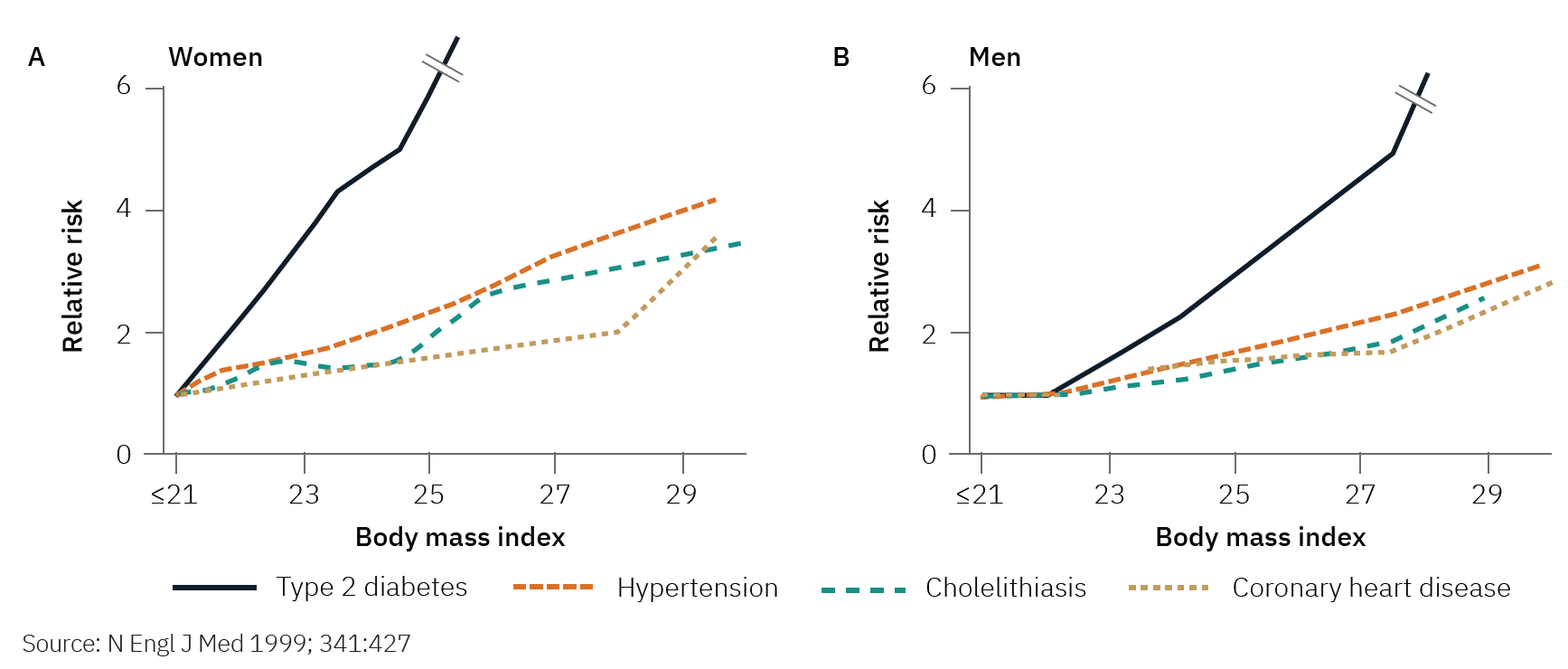

- Wolters Kluwer, UpToDate, 2022

- Association of body mass index with health care expenditures in the United States by age and sex, Z. Ward et al, 2021

- Global Obesity Epidemic to Cost US$1.2 Trillion Annually by 2025,” Food Tank, October 2017.

This document has been prepared and issued by Orca Funds Management Pty Limited (Investment Manager) (ACN 619 080 045, CAR No. 1255264), as investment manager for the Orca Global Disruption Fund (Fund) (ARSN 619 350 042). The Trust Company (RE Services) Limited (ABN 45 003 278 831, AFSL 235150) is the Responsible Entity of the Fund. For further information on the Fund please refer to the PDS and Target Market Determination which is available at orcafunds.com.au.

This document may contain general advice and should not be considered as medical advice. Any general advice provided has been prepared without taking into account your objectives, financial situation or needs. Before acting on the advice, you should consider the appropriateness of the advice with regard to your objectives, financial situation and needs. This document may contain statements, opinions, projections, forecasts and other material (forward-looking statements), based on various assumptions. Those assumptions may or may not prove to be correct.

The Investment Manager and its advisers (including all of their respective directors, consultants and/or employees, related bodies corporate and the directors, shareholders, managers, employees or agents of them) (Parties) do not make any representation as to the accuracy or likelihood of fulfilment of the forward-looking statements or any of the assumptions upon which they are based.

Actual results, performance or achievements may vary materially from any projections and forward-looking statements and the assumptions on which those statements are based. Readers are cautioned not to place undue reliance on forward looking statements and the Parties assume no obligation to update that information. The Parties give no warranty, representation or guarantee as to the accuracy, completeness or reliability of the information contained in this report. The Parties do not accept, except to the extent permitted by law, responsibility for any loss, claim, damages, costs or expenses arising out of, or in connection with, the information contained in this report. Any recipient of this report should independently satisfy themselves as to the accuracy of all information contained in this document.

This document is not intended to be a research report (as defined in ASIC Regulatory Guides 79 and 264). Unless otherwise indicated, all views expressed herein are the views of the author and may differ from or conflict with those of others within the group. The views expressed herein should be considered as part of a wider portfolio investment strategy applicable to the relevant fund or model portfolio and should not be considered in isolation or relied on to make an investment decision without seeking further information and/or advice from a financial adviser.

Orca Funds Management Pty Ltd is a wholely owned subsidiary of E&P Financial Group Limited (ABN 54 609 913 457), a signatory to the United Nations Principles for Responsible Investment (UNPRI).