Since launch in November 2022, ChatGPT has captured the public imagination in a way the tech world hasn’t seen since the introduction of the iPhone in 2007.

In this article, we explore the emergence of Generative AI (the technology that powers ChatGPT), how it could be disruptive, the implications for the broader economy, and how the Global Disruption Fund is positioned to potentially benefit from these trends.

What is Artificial Intelligence?

Artificial intelligence (AI) is traditionally defined as a field of science involving computers or machines to reason, learn and behave in ways typically requiring human intelligence.

Traditional or analytical AI involves the use of machines for analysis of existing data sets to establish relationships, find patterns and discover insights. Familiar AI applications include recommendation engines (e.g. Top Picks on Netflix, Discover on Spotify, Your recommendations on Amazon), image and speech recognition, language translation, and fraud detection.

Emergence of Generative AI

A new category of AI is Generative AI, where machines generate something new rather than analyzing something that already exists. Generative AI involves the use of machine learning models that can create and generate new content such as text, images, audio, video, code, art and more based on simple word-based prompts. While generative AI models have been around for some time, next generation models have advanced quickly, embracing new approaches to training, enabling greater accuracy. For example, OpenAI (owner of ChatGPT) announced that its latest AI model GPT 4 passed a simulated bar (US legal) exam with a score around the top 10%; this compared with the previous version GPT 3.5’s score around the bottom 10% only six months ago.

Why Now? The rapid advancements in Generative AI have been driven several of factors:

- Greater computing power with advancements in Graphics Processing Units (GPUs) making it possible to run multiple complex computations simultaneously in Generative AI models, which require significant computing power to train.

- Breakthroughs in AI research including the development of Transformer models (introduced by Google Brain in 2017), which changes the way neural network models sequence data and include mechanisms to help predict the next word in a sentence by analysing the most relevant parts of an input sentence.

- The proliferation of data that has fuelled the training of AI to be smarter and more efficient.

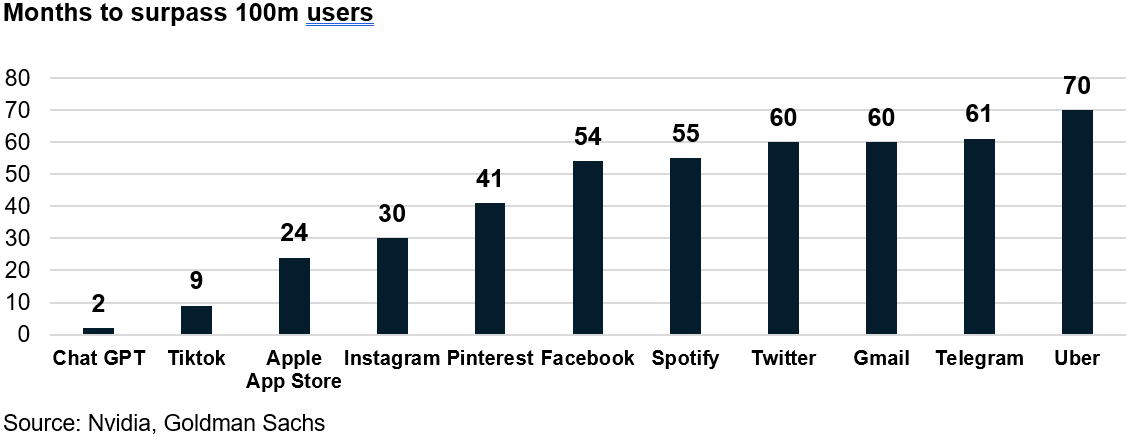

- The emergence of applications in 2022 that have driven awareness and mass user adoption. This includes Open AI’s text-to-image model DALL-E 2, and conversational chatbot ChatGPT which reached 100m users in two months, far more rapidly than any other application in history.